This midterm’s candidate races may look tight, but support for the two ballot measures are looking strong.

As of election night, Charter Amendment No. 1 — which moves all county elections to even years — received 69.17% approval of counted ballots.

And Proposition No. 1, a Conservation Futures Levy lid lift aiming to conserve open spaces, forests, salmon habitats, farmlands, trails, and more, received 67.60% approval.

Approximately 440,500 ballots have been counted, 31.83% of registered voters in the county. This means there are almost definitely ballots left to count, and the election won’t be certified until Nov. 29, so results can, and will, change.

To recap, here’s how these measures will affect your elections, and your wallet:

EVEN NUMBER ELECTION YEARS

Charter Amendment No. 1 is all about moving some odd-number year elections to even years.

This will affect elections for King County’s executive, some council members, its assessor, and its elections director.

With the amendment looking to pass, the assessor, elections director, and council members representing districts 2, 4, 6, and 8 will be held in 2026, rather than 2025. The county executive and remaining council members would have their election scheduled for 2028, rather than 2027.

This means that those elected in 2023 (consisting of the former group mentioned above) and 2025 (the latter), the last odd elections for the county, would serve only three terms before being up for election again. Four-year terms would resume after the even elections.

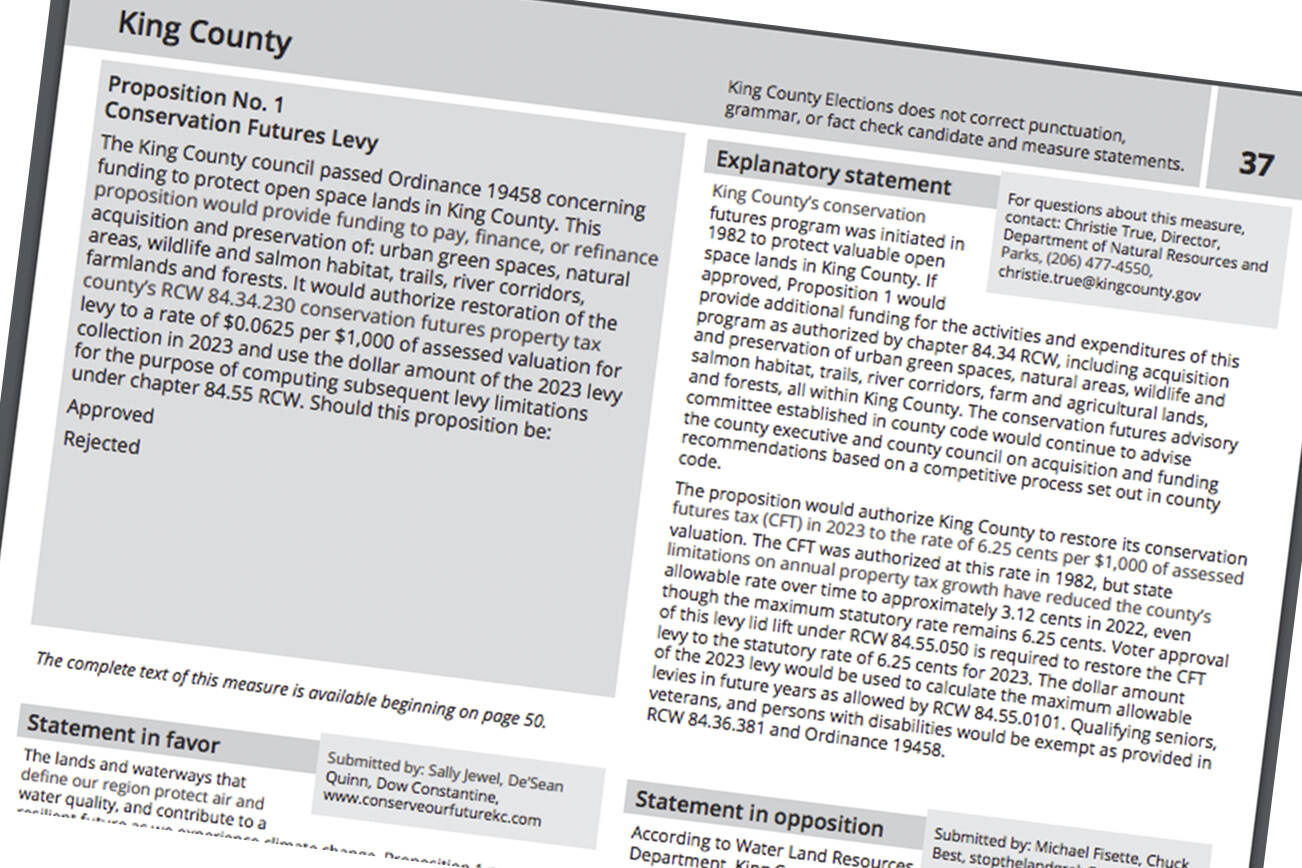

CONSERVATION FUTURES LEVY

This levy is not a new tax; King County implemented the Conservation Futures Levy more than 40 years ago, but this is the first time it’s back on the ballot, asking voters to reset the levy rate to its maximum of 6.25 cents (or $0.0625).

The levy collects property taxes to fund King County’s Land Conservation Initiative, which gives the county funds to buy open spaces — urban green spaces, natural areas, wildlife and salmon habitat, trails, river corridors, farm and agricultural lands, and forests — to preserve and protect them from development.

Also a part of the Land Conservation Initiative is King County’s Farmland Preservation Program, which has bought up the development rights of farms around Enumclaw, for example, to protect them from development. The FPP uses funds from collected through the Conservation Futures Levy.

Currently, the levy rate is at 3 cents per $1,000 in assessed property value. It’s shrunk since the levy was first implemented because state law says jurisdictions can only collect 1% more in revenue from property taxes over the previous year, so when property values increase at a faster rate, the tax rate must decrease to compensate. Resetting the levy rate to its maximum is officially called a “levy lid lift.”

At 3 cents, median property owners ($694,000 in property value) see an annual tax bill of about $21; doubling the tax rate would bring the annual tax bill to just over $43.

Although taxes from the levy are used to acquire control of open spaces, the Land Conservation Initiative doesn’t tackle these projects alone — cities, farmers, businesses, and nonprofits need to partner with the county and are usually required to pony up 50% of the necessary funds before the program purchases land. (There are exceptions where the match is waived.)

Talk to us

Please share your story tips by emailing editor@kentreporter.com.

To share your opinion for publication, submit a letter through our website https://www.kentreporter.com/submit-letter/. Include your name, address and daytime phone number. (We’ll only publish your name and hometown.) Please keep letters to 300 words or less.