Check your bank account.

You might be seeing some extra zeros, in a good way.

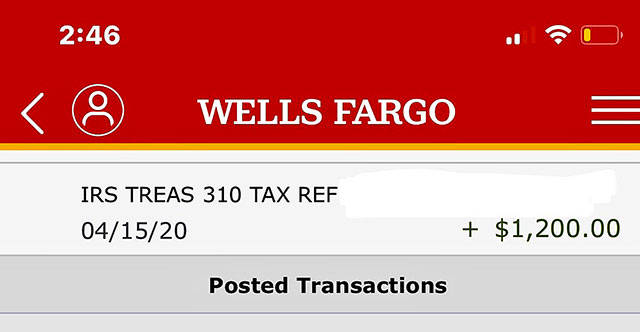

People this week started receiving their stimulus checks, a pandemic gift from the federal government.

The payment is $1,200 for single filers and $2,400 for married couples. Parents get $500 per dependent child under 17.

There are about 80 million checks going out. So if you didn’t get yours, be patient.

The first round went to those who filed their 2018 or 2019 tax returns and authorized the Internal Revenue Service to make a direct deposit. Social Security recipients automatically receive these bonus bucks, even those who haven’t filed a return.

This is free money. It is not considered income. It’s tax-free.

It’s part of the $2 trillion stimulus bill to reboot the economy and help people pay bills due to the commerce-crippling coronavirus.

The full payment goes to those with adjusted gross income up to $75,000 for individuals; $112,500 for head of household filers; and $150,000 for couples filing joint returns. Payments phase out with higher incomes.

Taxpayers who didn’t use direct deposit can put in their bank information using a new web portal, Get My Payment, on the IRS website. It beats waiting weeks or months for a paper check to show up in your mailbox.

President Donald Trump’s signature will appear in the “memo” section on checks sent and doesn’t show up on bank deposits.

The Get My Payment portal can also be used to check the status of your payment.

The IRS warns taxpayers to not fall for scam artists using email, phone calls or texts related to the payments. The agency does not electronically ask people to open attachments, visit a website or share personal or financial information.

Go to IRS.gov/coronavirus for more information.

Talk to us

Please share your story tips by emailing editor@kentreporter.com.

To share your opinion for publication, submit a letter through our website https://www.kentreporter.com/submit-letter/. Include your name, address and daytime phone number. (We’ll only publish your name and hometown.) Please keep letters to 300 words or less.