By Tim Gruver/WNPA Olympia News Bureau

You could be paying by the mile rather than by the gallon if a new program by the Washington State Department of Transportation (WSDOT) becomes standard for motorists.

Starting this fall, a 2½-year pilot program begins, experimenting with fees based on distance traveled rather than the amount of gas purchased. The live portion of the program includes up to 2,000 volunteer state motorists who will test one of four payment systems and then vote on a preferred method.

The first system involves purchasing a yearlong permit that allows motorists to drive unlimited miles. The second involves a smartphone signal that automatically tracks all miles traveled, with charges based on the time period covered. The third would charge participants by their odometer readings. The fourth would charge drivers based on an in-vehicle, automated mileage meter, which would include optional GPS features.

The pilot program is funded by a $3.8 million grant from the Federal Highway Administration. It includes participants from five transportation regions across the state. Following final evaluations, the test-program is expected to reach its conclusion by spring of 2019.

Other states have already implemented various road usage charges, including Oregon, whose OReGO program collects fees through an onboard GPS system. According to WSDOT Executive Director Reema Griffith, the state’s pilot program is designed to offer the maximum number of options to meet motorists’ needs and preferences.

“To assume one size fits all is not going to work,” Griffith said. “There are different levels of technology that should depend on the person in question. We want to allow flexibility and give consumers options.”

The program is only designed to charge individuals for driving on public Washington roads and not private property such as farms or business parking lots. According to Griffith, distinguishing such data is an issue still left for technology experts to resolve.

WSDOT does not collect fees from participants in the pilot program. Specific payment methods, whether by check or credit card, would be further explored if the pilot program advances to later stages. Drivers would continue to pay the current gas tax while road usage charges are being implemented. New fuel-efficient vehicles are expected to have road usage charge systems built into them.

Road usage charges would apply to all public roads within state borders: local, state and federal. The pilot program plans to use a combination of hybrid, electric, and gas-consuming vehicles.

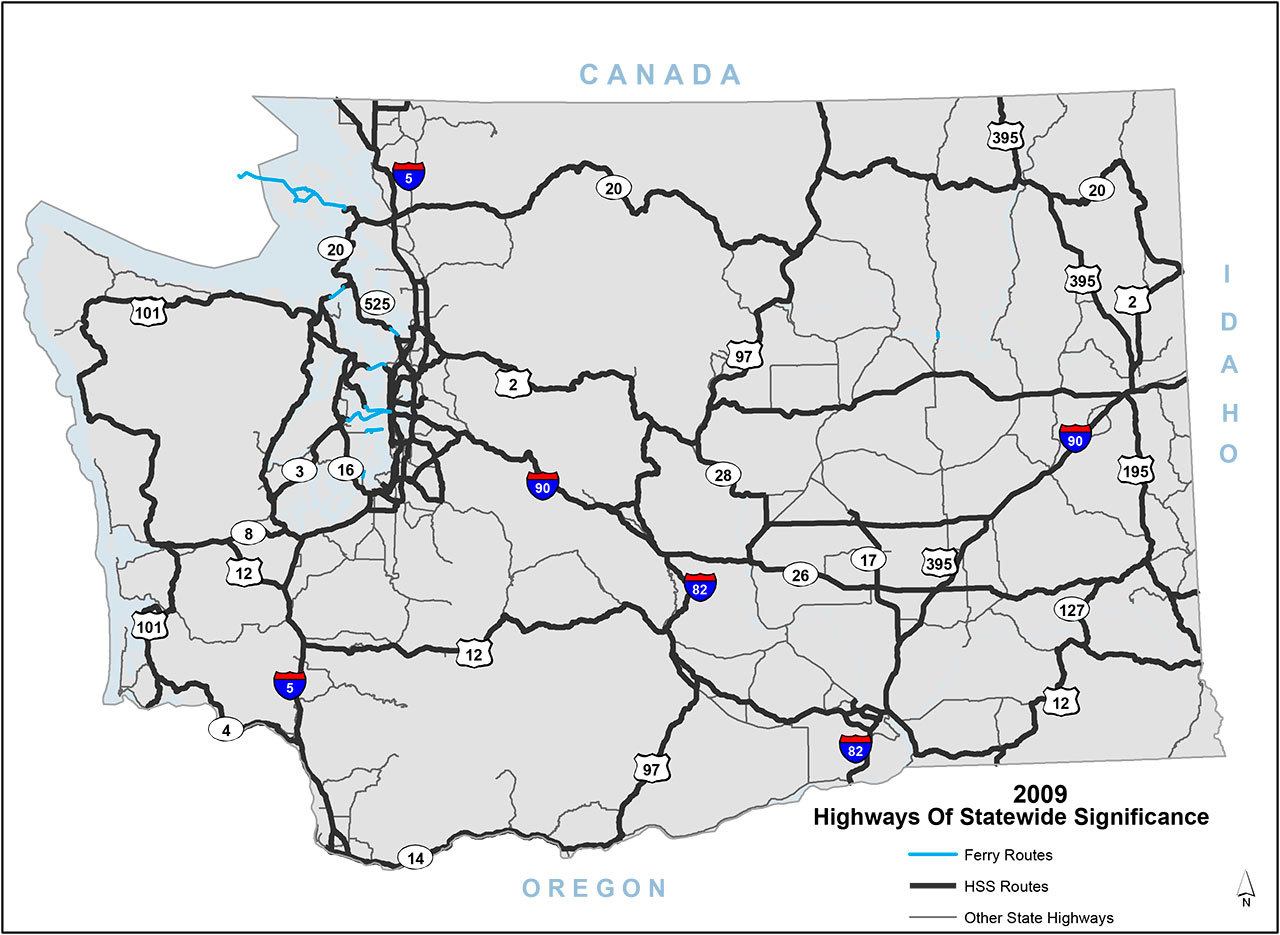

The gas tax would continue to serve as a means for taxing out-of-state motorists traveling on scenic highways like State Route 20, and who lack the necessary road-usage measuring and charge system.

“If they’re going to fill up in our state, they’re going to pay the gas tax,” Griffith said.

According to Janet Ray, assistant vice-president of corporate affairs for AAA Washington, road usage charges may be a fairer tax for motorists driving vehicles that get low gas mileage, especially those in rural areas.

“What we have seen with the current proposal, as outlined, is that … it means everyone pays a similar amount,” Ray said. “You pay the same amount if you get 20 miles per gallon, or if you get 40 miles per gallon, or if you get 10 miles per gallon.”

Game-journalist David Roberts, who works from home with his family in Everett, typically travels short distances to local grocery stores, restaurants or occasional trips to Seattle. As an infrequent driver, he expressed interest in the idea of road usage charges if they did not cost more in time and energy.

“It’s pricey, but I mean, I lived through the gas price hikes in 2008 and I don’t drive nearly as often as I used to, so it doesn’t hurt nearly as much,” Roberts said. “If the plan really is ‘drive less, pay less,’ then yes, it sounds more economical. But if it’s just transferring the cost from the pump to something I have to personally file, it’s no benefit and ultimately more work for me.”

Of the current systems offered by the pilot program, Roberts believed the highest tech solution is the most appealing for keeping peace of mind.

“Using a smartphone app would definitely be easier for me to keep track of,” Roberts said.

While the program’s higher tech options such as smartphones may invite concerns over personal privacy, the WSDOT would not collect, store, or analyze motorists’ real-time locations, according to Griffith. However, she said that privacy laws regarding such would have to be further explored by the state Legislature.

Though the program’s options offer greater variety, some, like Washington Trucking Associations Vice President Frank Riordan, question whether its complexity would be efficient in its onset.

“We have a vested interest in the procedure and how it would relate to trucking and the concern right now is, ‘How do we collect the charges? ” Riordan said. “Right now, the tax is pretty much paid when you go to (the fuel depot at Seattle’s) Harbor Island and it’s dumped into the tanker that goes to the gas station. Road usage charges are going to be collected individually so it goes from something quite simple to something quite complicated.”

Writer and state resident Jonathan Campbell believes that the cost of the current gas tax is negligible compared to the road usage charges.

“In some ways it’s better for me, because if I get gas in Washington, I’m paying the full brunt of the (gas tax) at the pump,” Campbell said. “Considering I don’t pay a state income tax, I’m OK with paying more at the pump. If it’s on me to record the miles or if I have to report mileage, it’ll be difficult to figure between the states.”

Griffith expressed concern that without road usage charges, the state gas tax would only generate less revenue with time as gasoline use declines. Washington has the second-highest gas tax in the nation.

“It would be like scooping up water with a paper cup,” Griffith said. “You can only do it for so long.”

Volunteer drivers may sign up to join WSDOT’s interest list at the pilot program’s official site: waroadusagecharge.org.

(This story is part of a series of news reports from the Washington State Legislature provided through a reporting internship sponsored by the Washington Newspaper Publishers Association Foundation. Reach reporter Tim Gruver at timgruver92@gmail.com)

Talk to us

Please share your story tips by emailing editor@kentreporter.com.

To share your opinion for publication, submit a letter through our website https://www.kentreporter.com/submit-letter/. Include your name, address and daytime phone number. (We’ll only publish your name and hometown.) Please keep letters to 300 words or less.